Affiliate Marketing in the USA Loan Industry

Affiliate marketing has become a powerful tool in the digital marketing world, and the financial sector is one of the biggest beneficiaries. In particular, the loan industry in the United States offers immense opportunities for affiliate marketers. With Americans constantly in search of personal loans, payday loans, student loans, mortgage refinancing, and business financing, there's a high demand for financial products. This demand creates a lucrative space for affiliate marketers to connect borrowers with lenders and earn commissions in return.

This article explores how affiliate marketing works in the USA loan industry, what makes it unique, how to get started, and the best practices for success.

What Is Affiliate Marketing?

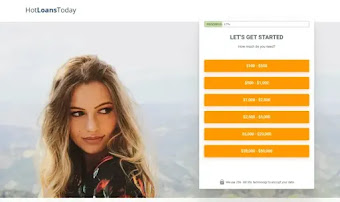

Affiliate marketing is a performance-based marketing strategy where individuals or companies (affiliates) promote a product or service on behalf of another business (the merchant or advertiser) in exchange for a commission. In the context of the loan industry, affiliates promote lending services such as personal loans, payday loans, student loans, or mortgage refinancing.

Affiliates usually use websites, blogs, email campaigns, social media, or paid ads to attract potential borrowers. When a user clicks on an affiliate link and completes a qualifying action—such as filling out a loan application—the affiliate earns a commission.

Why the Loan Industry Is Ideal for Affiliate Marketing

The U.S. loan market is massive. According to the Federal Reserve, Americans collectively owe over $17 trillion in various forms of debt, including mortgages, student loans, auto loans, and personal loans. With this large and growing market, loan companies are constantly looking for new borrowers. Affiliate marketing allows lenders to expand their reach efficiently by leveraging third-party marketers.

Key Benefits:

High Payouts: Loan affiliate programs often offer some of the highest payouts in the affiliate marketing space. Depending on the type of loan and the offer, commissions can range from $10 to $200+ per lead.

Diverse Loan Products: Affiliates can promote a wide range of financial products—personal loans, business loans, debt consolidation, auto loans, and more.

Evergreen Demand: People will always need loans, whether it’s for emergencies, education, housing, or starting a business.

Types of Loans to Promote as an Affiliate

Understanding different loan types helps affiliates target the right audience and choose suitable programs. Here are some common ones:

1. Personal Loans

Unsecured loans that can be used for various purposes, including debt consolidation, home improvement, or medical expenses. These are among the most commonly promoted products in affiliate programs.

2. Payday Loans

Short-term, high-interest loans targeted at borrowers who need quick cash. Though controversial due to high APRs, these loans offer high affiliate commissions due to their risk profile.

3. Student Loans and Refinancing

With rising education costs, many students seek financial aid. Affiliates can promote both federal and private student loans as well as refinancing options.

4. Mortgage Loans and Refinancing

Mortgage and refinance affiliate programs offer some of the highest payouts, especially when promoting to homeowners looking to lower interest rates or cash out home equity.

5. Business Loans

Targeted at entrepreneurs and small business owners. This includes SBA loans, merchant cash advances, and lines of credit.

How to Get Started in Loan Affiliate Marketing

1. Choose a Niche

Instead of promoting every type of loan, choose a specific niche like student loans or mortgage refinancing. Specializing allows you to build a more targeted audience and become a trusted authority.

2. Join Affiliate Programs or Networks

Some loan companies run their own affiliate programs, while others partner with affiliate networks. Popular networks include:

CJ Affiliate

MaxBounty

FlexOffers

Rakuten

LoanMatchingAffiliate

Each program has different terms, payment structures, and commission rates. Choose those that align with your niche and audience.

3. Build a Website or Blog

Your website is your main platform for attracting and educating potential borrowers. Create quality content around financial topics, loan comparisons, budgeting tips, and lender reviews.

4. Drive Traffic

To make commissions, you need traffic. Use strategies such as:

SEO: Optimize content for search engines using keywords like “best personal loans USA,” “how to refinance a mortgage,” etc.

Social Media: Share content, tips, and affiliate offers through platforms like Facebook, Instagram, and TikTok.

Email Marketing: Build a list and send regular updates and offers.

Paid Ads: Google Ads and Facebook Ads can be powerful when targeted effectively.

5. Disclose Affiliate Relationships

To stay compliant with FTC regulations, always disclose that your content contains affiliate links. Transparency builds trust with your audience.

Compliance and Legal Considerations

The U.S. financial market is heavily regulated. When promoting loan products as an affiliate, it's essential to comply with applicable laws, such as:

Truth in Lending Act (TILA): Ensures borrowers are informed about loan terms and costs.

Federal Trade Commission (FTC) guidelines: Requires proper disclosure of affiliate relationships.

State Lending Laws: Vary by state; ensure you understand geographic restrictions on certain offers.

Failing to comply can result in program termination, fines, or legal action.

Best Practices for Success

1. Create Value-Driven Content

Instead of just posting affiliate links, create content that educates users—loan calculators, comparison charts, FAQs, and financial tips are effective tools.

2. Focus on Trust and Credibility

People are cautious about borrowing money. Use honest reviews, testimonials, and data to build credibility.

3. Test and Optimize

Track performance metrics like click-through rates (CTR), conversion rates, and average commission per lead. Use A/B testing to find what works best.

4. Leverage Email Follow-Ups

Most people don't make loan decisions immediately. Build an email list and send a series of follow-up emails to nurture leads.

5. Stay Updated

Financial markets change. Keep up with industry trends, policy updates, and new affiliate programs to stay competitive.

Challenges in Loan Affiliate Marketing

High Competition: Financial niches are competitive and often dominated by large players.

Advertising Restrictions: Google and Facebook have strict policies for financial ads.

Regulatory Risks: Compliance requires diligence and attention to detail.

Despite these challenges, consistent effort and smart strategies can lead to long-term affiliate success.

Conclusion

Affiliate marketing in the USA loan industry is a high-reward opportunity for those willing to put in the work. With strong demand for financial services, high payouts, and a broad array of loan products to promote, it's an excellent niche for both new and seasoned marketers.

Success requires a mix of solid content, strategic promotion, compliance with legal standards, and continuous optimization. For affiliates who stay informed and genuinely help consumers make smarter financial decisions, the rewards can be both financial and fulfilling.

Comments

Post a Comment